Ma payroll calculator

Simply enter their federal and state W-4. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Massachusetts Paycheck Calculator Smartasset

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

. This contribution rate is less because small employers are not. So the tax year 2022 will start from July 01 2021 to June 30 2022. Ad Payroll Employment Law for 160 Countries.

SmartAssets Massachusetts paycheck calculator shows your hourly and salary income after federal state and local taxes. Enter your info to see your take home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. Massachusetts Hourly Paycheck Calculator. All Services Backed by Tax Guarantee.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Global salary benchmark and benefit data.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. Make sure you are locally compliant with Papaya Global help. Calculating paychecks and need some help.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Just enter the wages tax withholdings and other information. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Ad Payroll So Easy You Can Set It Up Run It Yourself. New employers pay 242 and new. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

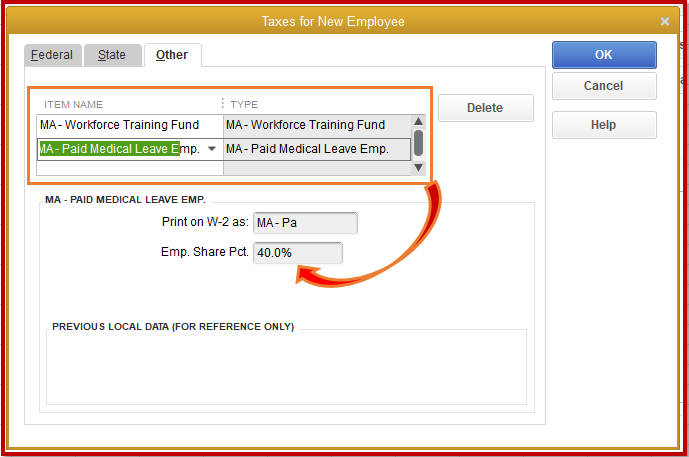

Payroll Calculator Free Employee Payroll Template For Excel

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Payroll Calculator Free Employee Payroll Template For Excel

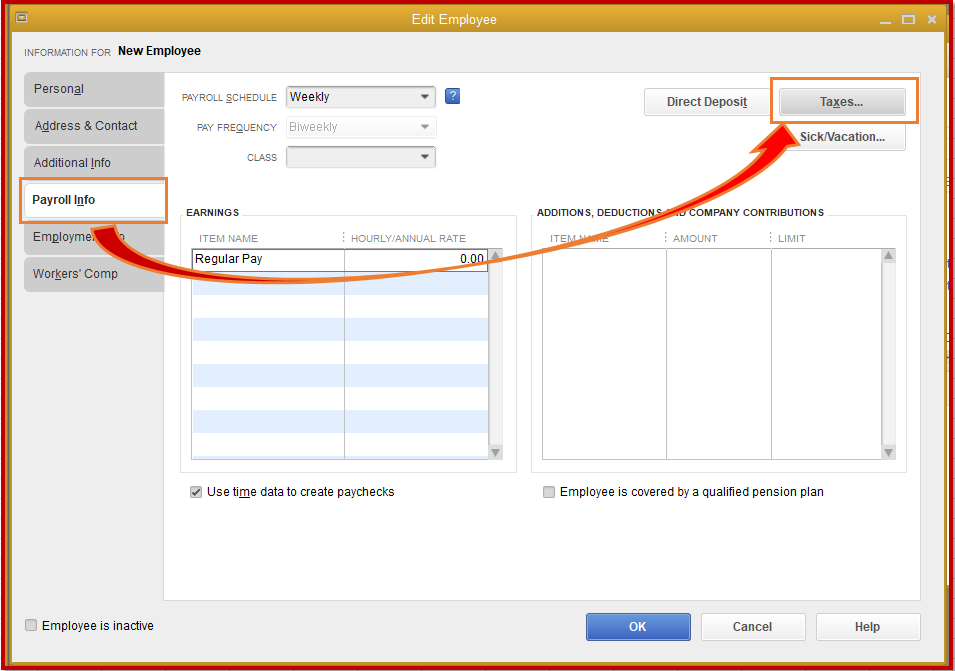

Massachusetts Paid Family Leave Not Calculating Correctly

How To Calculate Massachusetts Income Tax Withholdings

Massachusetts Paid Family Leave Not Calculating Correctly

How To Calculate Massachusetts Income Tax Withholdings

How To Calculate Massachusetts Income Tax Withholdings

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay

Payroll Calculator Free Employee Payroll Template For Excel

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

Massachusetts Fli Calculations

Forecast Payroll Calculations

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Software Solution For Massachusetts Small Business

How To Calculate Payroll Taxes Methods Examples More